Sell in May? Redux: Another 30 Years

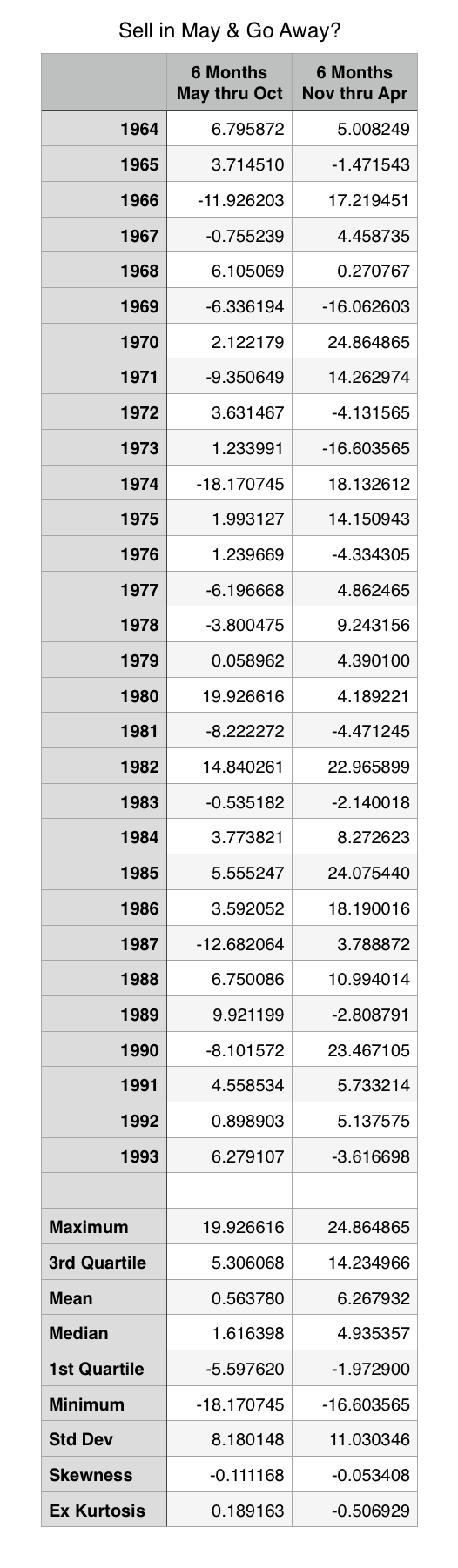

Following on yesterday’s post, I decided to extend our analysis back another 30 years to provide more context to the old adage of “Sell in May and go away”. Again, I’m using historical price data for the S&P 500 index (SPX), but this time with data covering the 30 years from 1964 to 1993.

Comparing the results from this period with results from the most resent 20 years in yesterday’s post, we find that the mean return for the most recent 20 years has actually increased from 0.56% to 1.39%, as well as the median, the 1st quartile, and the 3rd quartile. What has changed most significantly though is the magnitude of the minimum for the most recent 20 years. During the previous 30 years, the worst May to October loss was -18.17%, compared to -30.08% for the most recent 20 years. Just one data point, from May to Oct of 2008 results in the standard deviation, negative skewness and excess kurtosis to be significantly larger for the most recent 20 years compared to the previous 30 years.

So looking at this data with the help of an additional 30 years of data, we see that the more recent trend has actually been for marginally higher returns during the May to October period. While the 18 months of negative returns from November 2007 through April 2009 constitute a very significant market downturn, and can’t simply be cast aside as an outlier, removing just that one data point from the summer of 2008, would lead to the conclusion that there’s even less reason to arbitrarily “sell in May”.